7

used in Thailand’s trade during 1993 and

2011, and the other on the invoicing

shares of the Euro for 35 countries.

Using the experience of the Euro as a

benchmark, they predict the expected invoicing shares of RMB

today and conclude that the RMB has been significantly under-

used in trade invoicing.

Prof. Lai attributes the under-use to the lack of thick market

externalities associated with RMB use in international trade. He

urges China to relax its capital controls, allow full convertibility

of the RMB, and reform its financial sector much more deeply in

order for the offshore RMB market to help the RMB become a

major invoicing currency.

Reference:

Edwin L.-C. Lai and Xiangrong Yu (2014), “Invoicing Currency

in International Trade: An Empirical Investigation and Some

Implications for the Renminbi”, forthcoming in World Economy

Many serious discussions have been generated by the Chinese

government’s aspiration to internationalize the RMB. In an HKUST

IEMS academic seminar,

Edwin Lai

, Professor of Economics,

HKUST, offered his views on the RMB’s potential to become an

international currency in the Asian-Pacific region.

Ch i na ha s t a k en a s e r i e s o f s t ep s t o p romo t e RMB

internationalization since 2008, and newspaper headlines report

a huge volume of trade deals settled in the currency. However,

few reports describe the extent of the RMB’s use as an invoicing

currency, not just a settlement currency. Prof. Lai pointed out

that invoicing in RMB requires greater commitment from trade

partners and enables firms operating in China to effectively

hedge against exchange rate risks. Trade data suggest that only

a small fraction of China’s trade with foreign countries is invoiced

in RMB.

Prof. Lai and co-authors develop a model which shows that

there is a convex relationship between the invoicing share of a

currency and the economic size of the issuing country. Invoicing

decisions also depend upon thick market externalities, which

refers to the phenomenon that use of a currency by some

firms makes it more attractive to be used by other firms. Such

externalities are influenced by the degree of convertibility of the

currency, the degree of capital account openness and financial

market maturity of the issuing country.

They provide empirical support for their argument by analyzing

two data sets: one on the invoicing shares of eleven currencies

THE POTENTIAL OF THE RMB TO BE A MAJOR INVOICING

CURRENCY IN THE ASIAN-PACIFIC REGION

HKUST IEMS Academic Seminar (2014. 05.12)

The presentation slides as well as

the related paper are available at

The finding contributes to a better

u n d e r s t a n d i n g o f c o n t r a c t i n g

arrangements of firms in different

institutional settings. Compared to prior

research mainly on market-based economies such as the U.S.,

Prof Hung’s study reveals the value of political ties and market

credibility in a relationship-based economy that has institutional

characteristics similar to other emerging economies.

Reference:

Mingyi Hung, TJ Wong and Fang Zhang (2014), "The value of

political ties versus market credibility: Evidence from corporate

scandals in China", conditionally accepted at Contemporary

Accounting Research

Corporate scandals can be devastating. They not only cause

huge losses of market value to firms but also can trigger panic

and market instability, thus attracting great attention from

investors and regulators. In China, corporate scandals have

different levels of negative impact on firms’ value, depending

on the nature of the scandal, as discovered by

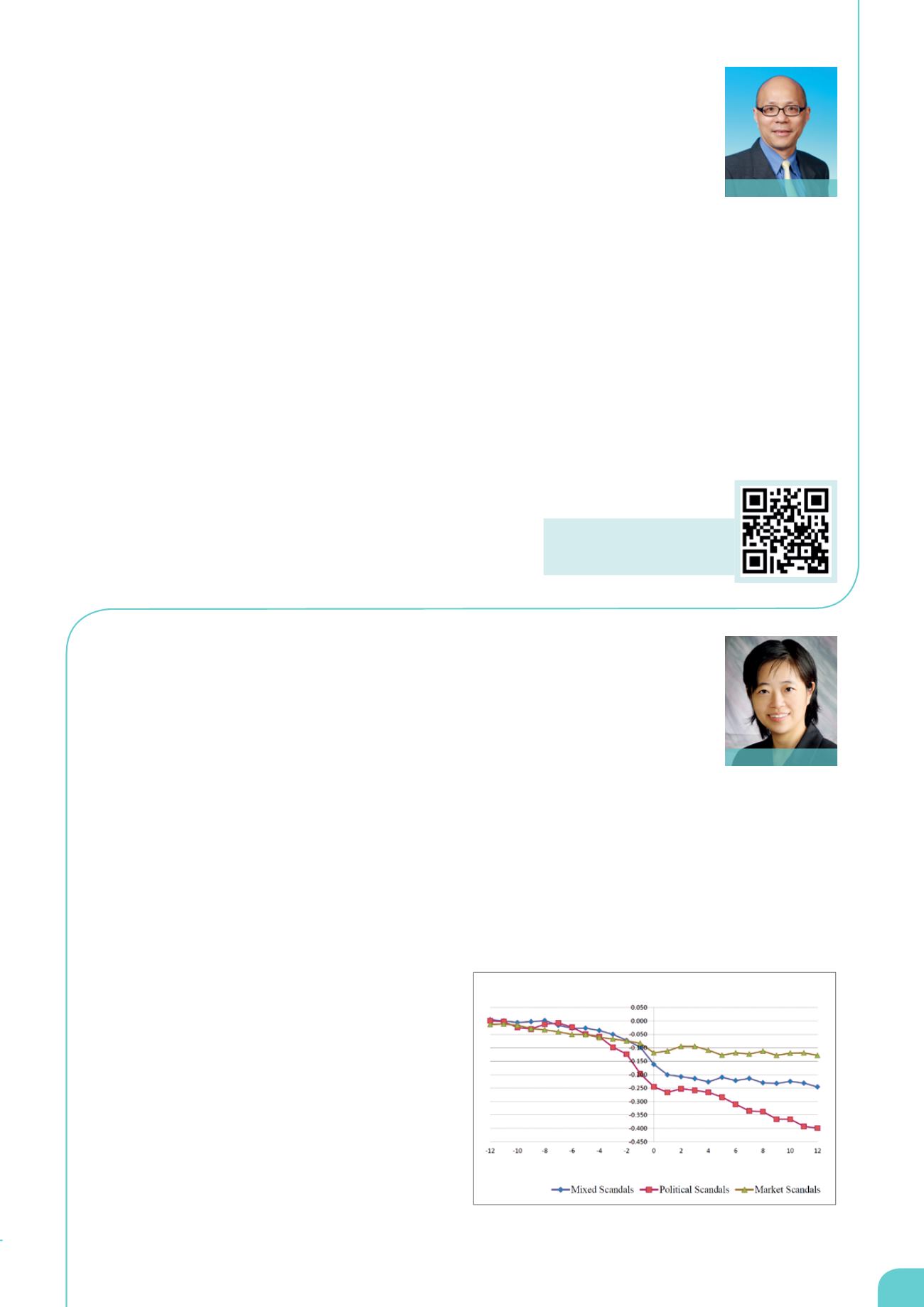

Mingyi Hung

,

Professor of Accounting, HKUST, in her research on corporate

scandals in Chinese firms. At a HKUST IEMS Academic Seminar,

she talked about how political scandals trigger worse market

reactions than market scandals.

The finding comes from an analysis of 212 enforcement

actions against corporate misconduct by Chinese courts and

securities regulators from 1997-2005. Prof. Hung and co-

authors categorized scandals into political scandals, market

scandals and mixed scandals, depending on whether the

scandal is primarily associated with the destruction of

political ties, market credibility, or both. Out of the 212

cases, they identified 26 political scandals such as managers

bribing government officials or stealing from the state

through tax evasion, 91 market scandals such as financial

misrepresentation and managers misappropriating firm

assets through embezzlement or kickbacks, and 95 mixed

scandals, such as embezzlement by managers of state-

owned enterprises (SOEs). They then employed an event

study methodology to test how the market reacts to these

different types of corporate scandals, as measured by the

firms’ cumulative abnormal returns (CARs), calculated as stock

returns minus returns of the market index during a certain

event window. The results suggested the value of a firm’s

political ties is greater than a firm’s market credibility. They

also found that compared to market scandals, political and

mixed scandals are more likely to lead to greater departure of

political and affiliated directors and larger decreases in loans

from state-owned banks.

THE VALUE OF POLITICAL TIES AND MARKET CREDIBILITY:

EVIDENCE FROM CORPORATE SCANDALS IN CHINA

HKUST IEMS Academic Seminar (2014. 03.03)

Characteristics-adjusted abnormal returns (CSARs) for different

types of scandals

Edwin Lai

Mingyi Hung

MONTHS SINCE SCANDAL